Table of Contents

What is First Insurance Funding?

First Insurance Funding is a company that specializes in providing premium financing solutions for insurance policies. Premium financing is a service that allows businesses and individuals to pay their insurance premiums in installments rather than a single lump sum. This makes it easier for policyholders to manage their cash flow while still maintaining the necessary insurance coverage.

History of First Insurance Funding

First Insurance Funding was founded in 1994 and has since grown to become a leading provider of premium financing in the United States and Canada. The company was established to address the need for a more flexible payment structure for insurance premiums. Over the years, First Insurance Funding has expanded its services and now offers a variety of financing options tailored to meet the needs of a diverse client base.

How Does Premium Financing Work?

Premium financing works similarly to a loan where a third-party lender, such as First Insurance Funding, pays the insurance premium on behalf of the policyholder. The policyholder then repays the lender in instalments over a specified period. This process typically involves the following steps:

- Application Process: The policyholder applies for premium financing through a lender like First Insurance Funding. The application usually requires information about the insurance policy and the policyholder’s financial situation.

- Approval and Agreement: Once the application is approved, the lender pays the full insurance premium directly to the insurance company.

- Repayment Plan: The policyholder agrees to a repayment plan which usually includes monthly instalments until the full amount (including any interest or fees) is paid off.

Benefits of Premium Financing

Improved Cash Flow Management

One of the main benefits of premium financing is that it allows businesses and individuals to spread out the cost of their insurance premiums over time. This can be particularly beneficial for businesses that need to manage their cash flow carefully.

Access to Higher Coverage

Premium financing can make it possible for businesses to afford higher levels of insurance coverage that might otherwise be too expensive if paid in a single lump sum. This can be crucial for businesses that need comprehensive coverage to protect against significant risks.

Convenience and Flexibility

By offering a variety of repayment plans, premium financing provides a convenient and flexible way to pay for insurance. This can make it easier for policyholders to budget for their insurance costs.

Services Offered by First Insurance Funding

First Insurance Funding offers a range of services designed to make premium financing as seamless as possible. Some of the key services include:

Commercial Premium Financing

This service is aimed at businesses that need to finance their commercial insurance premiums. It covers a wide range of insurance types, including property, liability, workers’ compensation, and more.

Personal Premium Financing

First Insurance Funding also offers premium financing for personal insurance policies such as life insurance, health insurance, and personal property insurance. This makes it easier for individuals to manage their insurance costs.

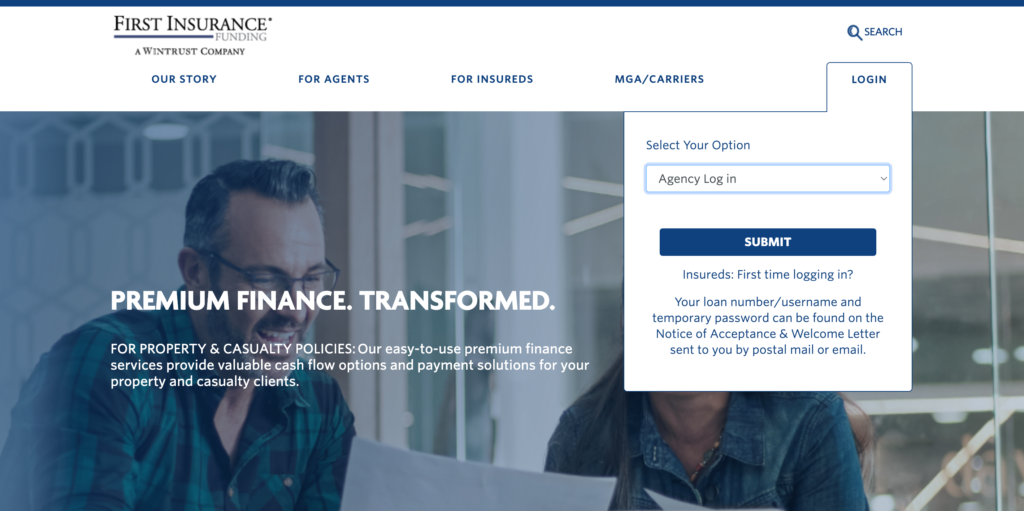

Online Account Management

The company provides an online platform where policyholders can manage their accounts, make payments, and view their financing details. This makes it easy for customers to stay on top of their premium financing agreements.

Customer Support

First Insurance Funding prides itself on offering excellent customer support. They have a team of professionals who are available to answer questions and provide assistance throughout the premium financing process.

The Importance of Premium Financing in the Insurance Industry

Premium financing plays a crucial role in the insurance industry by making insurance more accessible and affordable. It helps bridge the gap between the need for insurance coverage and the financial constraints that some policyholders face. By offering a way to pay for insurance premiums in installments, premium financing companies like First Insurance Funding make it possible for more people and businesses to obtain the coverage they need.

How to Apply for Premium Financing with First Insurance Funding

Applying for premium financing with First Insurance Funding is a straightforward process. Here are the typical steps involved:

- Contact an Insurance Broker or Agent: The first step is usually to contact an insurance broker or agent who works with First Insurance Funding. They can provide you with the necessary application forms and guide you through the process.

- Complete the Application Form: You will need to fill out an application form that includes details about your insurance policy and your financial situation.

- Submit Supporting Documents: Depending on the type of insurance and the amount of the premium, you may need to submit additional documents such as financial statements or proof of income.

- Review and Approval: First Insurance Funding will review your application and make a decision. If approved, they will pay the insurance premium directly to your insurance company.

- Set Up a Repayment Plan: You will need to agree to a repayment plan that outlines the installment amounts and the payment schedule.

Risks and Considerations

While premium financing offers many benefits, it is important to be aware of the potential risks and considerations:

Interest and Fees

Premium financing typically involves interest charges and possibly other fees. It is important to understand the total cost of financing and compare it to the benefits of spreading out your payments.

Default Risk

If you fail to make your installment payments, the lender may have the right to cancel your insurance policy. This could leave you without coverage and potentially result in a loss of any premiums already paid.

Creditworthiness

Your creditworthiness may affect your ability to secure premium financing. Lenders like First Insurance Funding will typically review your credit history and financial situation before approving your application.

First Insurance Funding’s Market Presence

First Insurance Funding has a significant presence in the premium financing market in both the United States and Canada. The company has built a reputation for reliability, customer service, and a wide range of financing options. They work with a network of insurance brokers and agents to make their services widely accessible.

Customer Testimonials and Reviews

Customer testimonials and reviews can provide valuable insights into the experiences of others who have used First Insurance Funding’s services. Many customers appreciate the company’s user-friendly online platform, responsive customer service, and the flexibility that premium financing provides. However, as with any financial service, it is important to read reviews and do your own research to make an informed decision.

Conclusion

First Insurance Funding plays a vital role in the insurance industry by offering premium financing solutions that make it easier for businesses and individuals to manage their insurance costs. By understanding how premium financing works and the services offered by First Insurance Funding, you can make an informed decision about whether this type of financing is right for you. Whether you need to finance a commercial insurance policy or a personal one, First Insurance Funding provides a range of options designed to meet your needs and help you maintain the necessary insurance coverage while managing your cash flow effectively.

Additional Resources

For more information about First Insurance Funding and premium financing, you can visit their official website or contact a local insurance broker who works with the company. Additionally, many financial advisors and insurance professionals can provide guidance on whether premium financing is a suitable option for your specific situation.

By making insurance premiums more manageable, First Insurance Funding helps ensure that more people and businesses can access the insurance coverage they need to protect themselves against various risks.