Why Inflation-Adjusted Returns Matter for Investors

inflation-adjusted return calculator-Inflation silently erodes the purchasing power of your money. A 10% annual return might sound impressive, but if inflation is 5%, your real rate of return is just 5%. Without accounting for inflation, investors risk overestimating their portfolio’s growth.

Example:

- Nominal Return: 10,000 invested with a 710,000 invested with a 719,672 in 10 years.

- Inflation-Adjusted Return (3% inflation): Real value = $14,802.

Our inflation-adjusted return calculator helps you uncover the truth behind your investment performance.

Table of Contents

How to Use the Inflation-Adjusted Return Calculator

- Enter Initial Investment: Input your starting amount (e.g., $10,000).

- Annual Return Rate: Add your investment’s average yearly return (e.g., 7%).

- Inflation Rate: Use historical averages (3%) or current rates (2023: 6.5%).

- Time Horizon: Select years (e.g., 10, 20, or 30 years).

Try It Now:

Inflation-Adjusted Return Calculator

Results

Nominal Future Value: $0.00

Inflation-Adjusted Value: $0.00

What is Inflation-Adjusted Return ?

Inflation-Adjusted Return (also called Real Return) is the profit or loss on an investment after accounting for the effects of inflation. It shows how much your money actually grew in purchasing power, not just in nominal dollar terms.

Why It’s Important

Inflation silently reduces your purchasing power over time. If your investments don’t outpace inflation, you’re effectively losing wealth.

- 100today≠100today=100 in 10 years: At 3% inflation, 100 today will only have the buying power of∗∗100 today will only have the buying power of∗∗74** in a decade.

- Goal: Earn returns above inflation to grow your wealth in real terms.

Case Study: Inflation’s Impact on Retirement Savings

Sarah invested $100,000 in an index fund averaging 8% annual returns. After 30 years:

- Nominal Value: $1,006,266.

- Inflation-Adjusted Value (3% inflation): $411,987.

Key Takeaway: Ignoring inflation could leave retirees with 60% less purchasing power than expected.

Why “Real Rate of Return” Beats Nominal Returns

- Nominal Returns: Raw percentage gains (no inflation adjustment).

- Real Returns: True growth of your wealth after inflation.

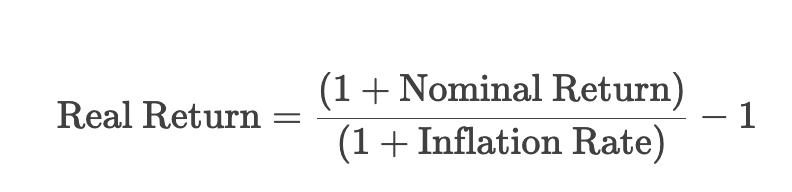

Formula:

Our purchasing power calculator automates this math, so you don’t have to.

Historical Inflation Trends: What Investors Should Know

- 1980–2023 Average Inflation: 3.5% (U.S.)

- 2022–2023 Spike: Peaked at 9.1% in 2022 (post-pandemic supply shocks).

Pro Tip: Use conservative inflation estimates (3–4%) for long-term planning.

FAQs About Inflation-Adjusted Returns

How often should I check my real returns?

Recalculate annually or when inflation spikes.

Which investments beat inflation best?

Stocks, real estate, and TIPS (Treasury Inflation-Protected Securities).

Where can I find historical inflation data?

Use the U.S. Bureau of Labor Statistics (BLS) CPI database.