Best Free Budgeting Apps for Freelancers: – Freelancing offers incredible freedom—set your hours, pick your projects, and work from anywhere. But with that freedom comes a financial catch: irregular income, unpredictable expenses, and no employer to handle taxes or benefits. If you’re a freelancer, you’ve likely felt the stress of wondering whether you’re saving enough or if you’ll have cash to cover next month’s bills. That’s where budgeting apps come in. They’re like a financial sidekick, helping you track your money, plan for the future, and stay sane amidst the chaos of self-employment.

Table of Contents

The good news? You don’t need to spend a dime to get started. There are plenty of free budgeting apps out there, and many are perfect for freelancers’ unique needs—like managing multiple income streams or setting aside funds for taxes. In this article, we’ll dive deep into the best free budgeting apps for freelancers, exploring their features, benefits, and quirks. I’ll share insights from my research, sprinkle in some real-world examples, and help you figure out which app might be your financial game-changer. By the end, you’ll have a clear roadmap to take control of your money—no jargon, no fluff, just practical advice from someone who gets it.

Ready to stop stressing about finances and start thriving as a freelancer? Let’s get into it.

Why Freelancers Need Budgeting Apps

Before we jump into the apps, let’s talk about why budgeting is non-negotiable for freelancers. Unlike a 9-to-5 gig with a steady paycheck, freelancing income can feel like a rollercoaster—feast one month, famine the next. One survey from Upwork found that 59% of freelancers say they experience cash flow challenges due to this inconsistency. Add in the fact that you’re on the hook for self-employment taxes, health insurance, and retirement savings, and it’s clear: without a plan, your finances can spiral fast.

A budgeting app isn’t just a nice-to-have—it’s a lifeline. Here’s what it can do for you:

- Track every dollar: See exactly how much you’re earning from clients and where it’s going.

- Smooth out the ups and downs: Plan for lean months so you’re not caught off guard.

- Save for taxes: Avoid the panic of a massive tax bill by setting money aside as you go.

- Reach your goals: Whether it’s a new laptop or a dream vacation, a budget keeps you on track.

Now, let’s explore the best free budgeting apps for freelancers that can make this happen. I’ve dug into the top options, tested their features, and thought about how they fit into a freelancer’s life—so you don’t have to.

Top 10 Free Budgeting Apps for Freelancers

1. Mint: Your All-in-One Financial Dashboard

What It Is: Mint is a household name in budgeting and is free. It syncs with your bank accounts and gives you a bird’s-eye view of your finances.

Key Features:

- Links to your accounts to automatically track spending and income.

- It lets you create custom budgets for things like rent, client lunches, or software subscriptions.

- Sends bill reminders so you never miss a payment.

- Monitors your credit score for free.

Why Freelancers Love It: If you’re juggling income from multiple clients—say, a graphic design gig here, a writing project there—Mint pulls it all together. You can set up a “tax savings” category and watch it grow, or see if that coffee shop habit is eating into your profits.

Real-World Example: Sarah, a freelance photographer, uses Mint to track her income from weddings and portrait sessions. She sets a budget for gear maintenance and knows exactly when she can splurge on a new lens.

Pros:

- Super easy to use, even if you’re not a numbers person.

- Gives you a full financial picture in minutes.

- Free with no hidden catches.

Cons:

- Ads for loans or credit cards can pop up.

- Not the best for tracking investments.

Pair Mint with our guide on how to manage irregular income as a freelancer for a killer combo.

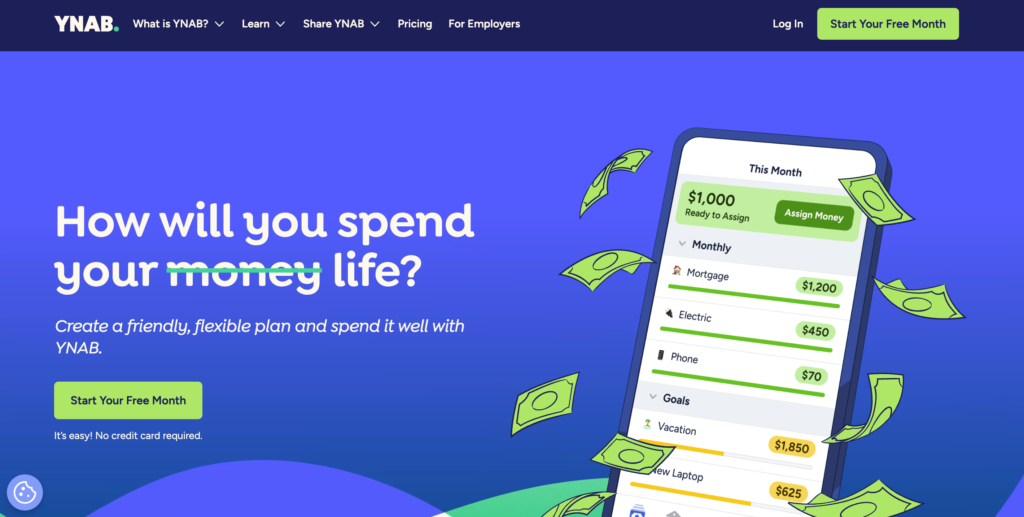

2. YNAB (You Need a Budget): Master Your Money

What It Is: YNAB uses a zero-based budgeting system—every dollar gets a job. It’s free for 34 days, then paid, but its approach is gold for freelancers.

Key Features:

- Assigns every dollar a purpose (bills, savings, etc.).

- Syncs with your accounts in real-time.

- Offers free workshops to teach you the ropes.

- Tracks goals like saving for a slow season.

Why Freelancers Love It: That Irregular Income? YNAB helps you plan for it. Let’s say you earn $5,000 one month—you allocate $2,000 to expenses, $1,000 to taxes, and $2,000 to savings for a dry spell. No guesswork, just clarity.

Real-World Example: Jake, a freelance developer, swears by YNAB. After a big project paid out, he used it to stash cash for a three-month buffer—peace of mind he hadn’t had before.

Pros:

- Forces you to think ahead (in a good way).

- Tons of support to help you learn.

- Keeps your budget current.

Cons:

- Takes time to get the hang of.

- Costs $14.99/month after the trial.

New to budgeting? Check out budgeting basics for freelancers to ease into it.

3. PocketGuard: Simple and Straightforward

What It Is: PocketGuard tells you what’s “in your pocket” after bills and savings—a no-fuss budgeting app with a free version.

Key Features:

- Shows your leftover cash after essentials.

- Auto-categorizes your spending.

- Tracks subscriptions and bills.

- Sets savings goals.

Why Freelancers Love It: Time is money, and PocketGuard gets that. If you’re too busy to micromanage, its “In My Pocket” feature gives you a quick green light to spend—or a red flag to hold off.

Real-World Example: Maria, a freelance writer, loves how PocketGuard flags her disposable income. After a $1,200 payment, it showed she had $300 left after bills—enough for a celebratory dinner.

Pros:

- Clean, simple design.

- Spots sneaky spending habits.

- Fast to set up.

Cons:

- Less customizable than others.

- Premium features cost extra.

Dig deeper into tracking business expenses as a freelancer.

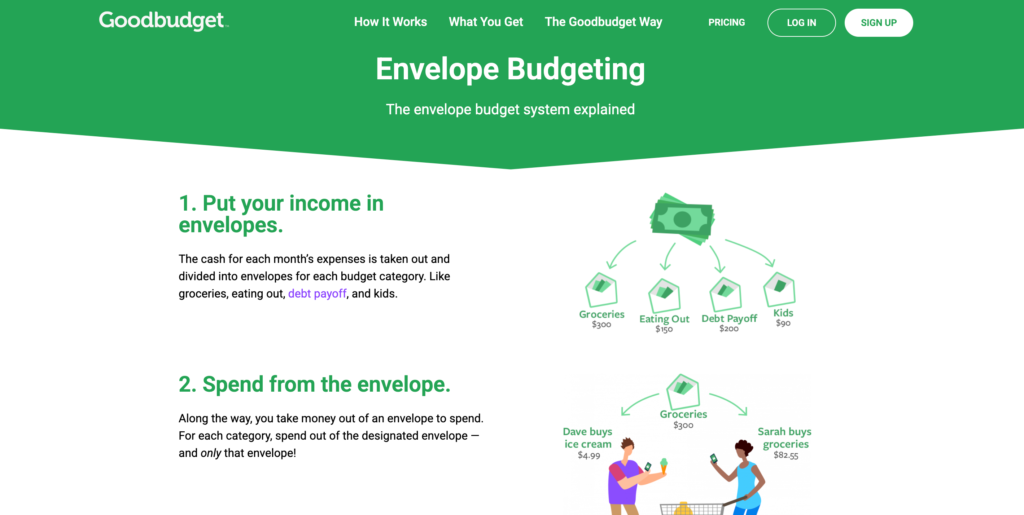

4. Goodbudget: Old-School Envelope Style

What It Is: Goodbudget brings the envelope system into the digital age. You divide your money into “envelopes” for different needs—free with limits.

Key Features:

- Fill envelopes for rent, taxes, or projects.

- Syncs with others (great for team projects).

- Tracks debt repayment.

- Shows spending trends.

Why Freelancers Love It: Imagine an envelope for each client gig. You put $500 in “Client A” for expenses, $200 in “Taxes,” and so on. It’s visual and keeps you disciplined.

Real-World Example: Tom, a freelance marketer, uses Goodbudget to separate client budgets. When a campaign needed extra ad spend, he knew exactly what he could shift.

Pros:

- No bank linking is needed.

- Perfect for control freaks.

- Syncs with partners or teams.

Cons:

- Manual entry takes effort.

- The free version limits envelopes.

Explore different budgeting techniques for freelancers for more ideas.

5. EveryDollar: Goal-Driven Budgeting

What It Is: Created by Dave Ramsey’s team, EveryDollar keeps budgeting simple and goal-focused. The free version is solid for starters.

Key Features:

- Zero-based budgeting is made easy.

- Custom categories for your needs.

- Debt payoff tools.

- Manual tracking in the free plan.

Why Freelancers Love It: Want to pay off student loans or save for a conference? EveryDollar keeps your eyes on the prize while managing daily cash flow.

Real-World Example: Lisa, a freelance illustrator, used EveryDollar to tackle $5,000 in credit card debt. She budgeted every gig’s income and cleared it in a year.

Pros:

- Dead simple to use.

- Motivates you with goals.

- Flexible categories.

Cons:

- No bank sync in the free version.

- Paid plan ($79.99/year) adds more.

Struggling with debt? See managing debt as a freelancer.

6. Wally: Budgeting with a Visual Twist

What It Is: Wally is a sleek, free app that makes tracking expenses feel less like a chore, with a focus on visuals.

Key Features:

- Log expenses manually or scan receipts.

- Set budgets with pretty charts.

- Supports multiple currencies.

- Shows spending patterns.

Why Freelancers Love It: Work with international clients? Wally handles euros, dollars, or yen. Plus, scanning receipts is a breeze for tax-deductible expenses.

Real-World Example: Alex, a freelance translator, uses Wally to track euros from European clients. A quick receipt scan logs his coworking space costs.

Pros:

- Eye-catching design.

- Great for global freelancers.

- Easy expense logging.

Cons:

- No auto-sync with banks.

- Fewer advanced features.

Master expense tracking with best practices for expense tracking.

7. Personal Capital: Budgeting Meets Investing

What It Is: Personal Capital blends budgeting with investment tracking—all free (though it pushes wealth management services).

Key Features:

- Tracks income and expenses.

- Monitors investments and net worth.

- Analyzes fees in your accounts.

- Custom spending categories.

Why Freelancers Love It: It’s not just about today’s budget—it’s about tomorrow’s wealth. Freelancers building a nest egg love the dual focus.

Real-World Example: Dana, a freelance consultant, uses Personal Capital to track her Roth IRA alongside her monthly budget. She caught a hidden fee eating into her returns.

Pros:

- Big-picture financial view.

- Free and robust.

- Investment insights.

Cons:

- Budgeting isn’t the main focus.

- Can overwhelm newbies.

Curious about investing? Read investment strategies for freelancers.

8. Spendee: Budgeting with a Team

What It Is: Spendee offers shared budgeting in a free version, perfect for freelancers collaborating with others.

Key Features:

- Share wallets with partners or teams.

- Auto-categorizes spending.

- Supports multiple currencies.

- Detailed spending reports.

Why Freelancers Love It: Working with a designer on a project? Share a wallet to track joint expenses. It’s also handy for household budgets.

Real-World Example: Emma, a freelance event planner, uses Spendee with her assistant to monitor event costs. They stay under budget every time.

Pros:

- Collaboration made easy.

- Sleek, modern interface.

- Multi-currency friendly.

Cons:

- Premium unlocks better features.

- Limited bank syncing.

See budgeting for couples for shared finance tips.

9. MoneyPatrol: Built for Freelancers

What It Is: MoneyPatrol is a lesser-known gem designed with freelancers in mind—free with powerful tools.

Key Features:

- Tracks income from gigs.

- Manages project budgets.

- Estimates taxes.

- Categorizes expenses.

Why Freelancers Love It: It’s like it was made for us. Set a budget per project, track every penny, and never miss a tax deadline.

Real-World Example: Carlos, a freelance videographer, uses MoneyPatrol to budget shoots. He saved $800 last year by estimating taxes upfront.

Pros:

- Freelancer-focused features.

- Tax planning built in.

- Detailed tracking.

Cons:

- Not as mainstream.

- May take time to learn.

Get tax-ready with tax tips for freelancers.

10. Emma: AI-Powered Budgeting

What It Is: Emma uses AI to give you smart money tips—free with some premium extras.

Key Features:

- AI suggests savings ideas.

- Tracks subscriptions.

- Sets budget limits.

- Monitors investments.

Why Freelancers Love It: That $10/month app you forgot about? Emma finds it. Its insights help you stretch every freelance dollar.

Real-World Example: Mia, a freelance copywriter, cut $50/month in subscriptions thanks to Emma’s alerts—more cash for her emergency fund.

Pros:

- Clever, tailored advice.

- Sleek and simple.

- Spots wasteful spending.

Cons:

- Some features cost extra.

- Limited availability by region.

Trim costs with how to cut unnecessary expenses.

How to Pick the Perfect App for You

So, which of these best free budgeting apps for freelancers is your match? It depends on your style and needs. Here’s a quick checklist:

- Are you busy? PocketGuard or Mint for simplicity.

- Love control? YNAB or Goodbudget for hands-on planning.

- Global gigs? Wally or Spendee for currency support.

- Big goals? Every dollar or Personal Capital for focus.

- Team player? Spendee for collaboration.

- Tax worrier? MoneyPatrol’s got your back.

Try a few—most offer free versions or trials. The right app is the one you’ll stick with.

Conclusion: Take Charge of Your Freelance Finances

Freelancing is a wild ride, but your finances don’t have to be. The best free budgeting apps for freelancers—from Mint’s all-in-one power to MoneyPatrol’s niche focus—give you the tools to track, plan, and succeed. No more guessing if you can afford that coworking membership or scrambling when tax season hits. Pick an app, start small, and watch your money stress melt away.

Test a couple of these apps this week. Find one that clicks with how you work and watch your financial confidence soar. You’ve got the skills to kill it as a freelancer—now let’s make sure your bank account agrees.

FAQs

1. What’s the best free budgeting app for freelancers with irregular income?

YNAB’s zero-based budgeting is a champ at handling ups and downs—plan every dollar, even when income’s unpredictable. PocketGuard’s quick “In My Pocket” view is another winner for fast clarity.

2. Can I track personal and business expenses in these apps?

Absolutely! Mint, YNAB, and MoneyPatrol let you split categories—think “Groceries” vs. “Client Software.” It’s a game-changer for keeping work and life straight.

3. Do these apps help with freelance taxes?

Some, like MoneyPatrol, estimate taxes directly. Others, like Mint or Goodbudget, let you create a “tax fund” category. Either way, you’ll be ready for Uncle Sam.

4. Are these apps safe to use?

Yes—reputable apps use bank-grade encryption. Still, peek at their privacy policies and stick to well-known names to keep your data locked tight.